Every few weeks I am reminded about a Tiger Cub against my will. Tiger Cubs are like the Disney Channel stars of hedge funds - Alumnus of a big brand (Tiger Management), that has set them up for enough fame to launch their solo careers - which don’t go great - but continue to be covered by the news years after relevance.

This week, that Tiger Cub is Chase Coleman, who has regained control of Tiger Global’s Venture Unit which is… somehow still kicking? In 2022 Tiger Global lost something to the tune of $25b, and I sort of zoned out after I realized they’d need to gain 90% to recover from losses. There is this age-old question in finance of, If you had a billion dollars how would you invest it?, to which Tiger Global answered in 2022 with, Easy, we burn it leveraged growth beta with a sprinkle of punting the dirty work to Bain.

Anyway, I know that the focus of the latest article is supposed to be about Chase Coleman stepping in to save the venture fund from scapegoat Scott Schleifer (who is not even Tiger's first human sacrifice), but I’m sorry to report to the Tiger Global marketing and IR teams “anonymous sources” of this article that I am simply TOO distracted by these few lines from the piece:

Coleman also spent this year engaging more with clients

Clients have expressed a range of opinions

So clients in its venture funds are in it for the long-haul

…according to clients

I’m sorry…who? Who are the clients still invested in this fund? Where are they! Are they sentient? Being threatened? @Clients: blink once if you’re being blackmailed to stick with Tiger Global, and twice if you just really love those “due diligence” steak dinners. Truly, the only thing more masochistic than making tens of billions go bye-bye is paying a 2% fee for front row seats.

Anyway, since he won’t let up, let’s talk about Mr. Chase Coleman! Upon Googling ‘Chase Coleman’, I was asked Do you mean Chase Coleman III? To which I thought, yeah probably, that tracks! But digging deeper into Chase Coleman The Third I was transported to another dimension that I was not ready for…I had forgotten that this man is not your run-of-the-mill nepo baby. He is the nepo baby. He is max leveraged nepo cub, fueling his own bubble of nepo-ness! He is so nepo, in fact, that he doesn’t even have the wherewithal to pay a junior nepo summer analyst to scrub the nepo out of his Wikipedia page:

His grandfather…was a descendant of Peter Stuyvesant, the last Dutch Governor who surrendered New Amsterdam to the British.

Coleman started his career in 1997, working for Julian Robertson and the latter's hedge fund, Tiger Management. He had grown up with Robertson's son, Spencer, who lived close to Glen Head, in Locust Valley.

“I’ve known Chase since he was a young boy on Long Island and a good friend of my son Spencer,” [Julian] Robertson said.

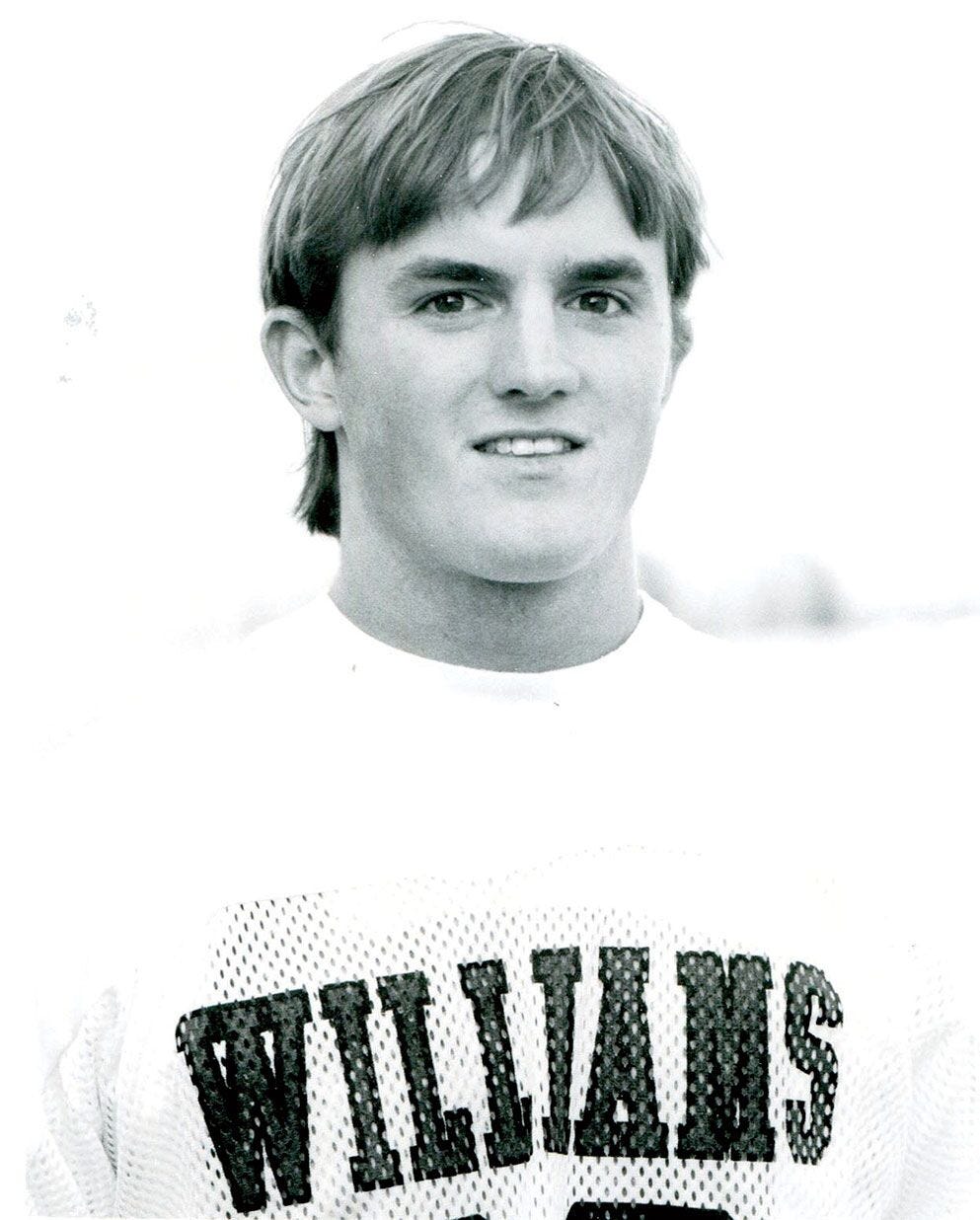

Coleman followed his father to both Deerfield Academy and Williams College, where he graduated in 1997, and was co-captain of the lacrosse team.

Coleman married Stephanie Ercklentz… Ercklentz was featured in the film, Born Rich, a 2003 documentary about growing up in the world's richest families.

I’m not saying there’s anything wrong with these things individually (except for maybe the Deerfield lacrosse-to-finance pipeline), but taken together… the sum of Chase Coleman The Third is greater than all of his blue-blooded parts! What’s more, the fact that he has probably read his own Wikipedia bio and had absolutely nothing to add…He doesn’t even want to spice it up with an anecdote about his first lemonade stand, or “an academic interest in economics at a young age”? I would even settle for a formative study abroad in Europe! But no, Chase Coleman The Third read that Wikipedia bio and said, “No notes!”

Yes Chasey, just like Tiger Global’s diligence on investments like FTX and Bytedance: No. Notes.